In 1970s, the Black-Scholes model became the basis for valuing financial derivatives. The market size is estimated to be $1 quadrillion ($1000 trillion or 1 followed by fifteen zeros)!

Derivatives are complex financial instruments, but simplistically can be thought of as deriving its value from some other entity. For example, car insurance premium is determined by the type of car, age of the drivers, location, length of insurance, etc. Unlike shares and bonds which have a linear payoff (if you buy something at 100 and it goes to 120, you make a gain of 20 and likewise if it goes to 80 you loose 20), derivatives have a non-linear payoff. The building blocks of derivatives are call option and put option.

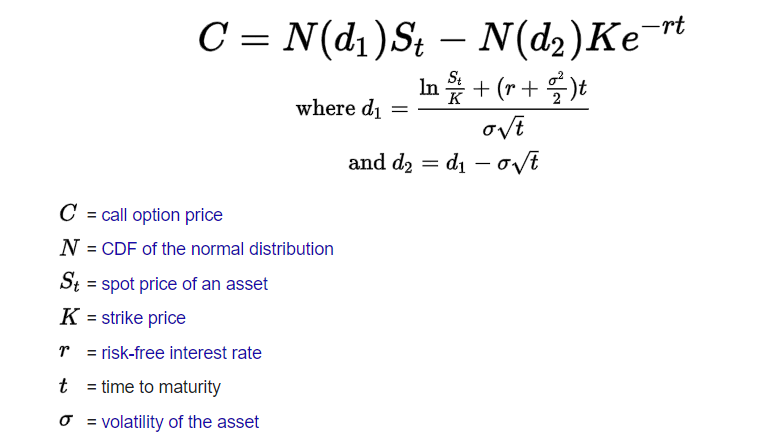

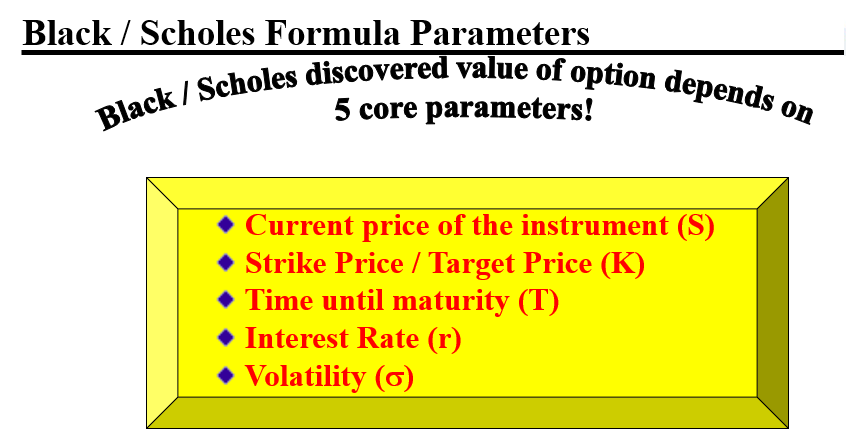

Whilst the formula for determining the value of a Call option looks very complex, the value of an option is calculated using 5 main inputs.

The above 5 parameters determine the value of a financial derivative.

How can this be applied to determine the Value of Jainism?

(1) Being born in a Jain family is not an option. However, anyone (not necessarily only those born in a Jain family) can choose to follow the Jain philosophy. This choice is an option, not a compulsion.

The first parameter to determine the value of an option is the SPOT Price. The spot price can be thought of your current belief system (one could either be an atheist, have some faith in Jainism or be very devout). For a financial derivative (call option), the higher the Spot price, the greater is the value of the derivative. Therefore, those who realise that the pristine Jain philosophy propounds the truth to self realisation and liberation, the “spot price” is priceless and thus the value of the option to practise the Jain religion is very, very high indeed. Lord Mahaveer advised his chief disciple Gautumswamy “O! blessed soul, as a fallow leaf of a tree falls to the ground when its days are gone, even so is this life of humans; Gautum, be careful all the time”. He also said “A rare chance, in a long course of time a soul has acquired human birth, be aware of the consequences of all actions and thus be vigilant all the time”. These words of Lord Mahaveer convey that we are very fortunate to be born as humans and presented with a wonderful opportunity to enhance our faith, speech and conduct for our spiritual progress. Thus, do not waste this OPTION of understanding the gems and treasures of the Jain philosophy. The value of this OPTION is priceless!

(ii) The second criteria to determine the Option value is the Strike price. For financial derivatives (call option), the closer the Strike price is to the Spot price, the greater the value of the option. Applying this concept to Jainism, each individual should choose to practise religion according to their prevalent level to maximise the utility of dharma (religion). As each person keeps on advancing, they can keep on raising their sadhana (efforts) to strive further in their spiritual aspirations. aims & ambitions. Let’s take an example. It is of no use to tell a small child to read a book on calculus. However, at that stage of their life, they need simpler books on how to read, learn maths, etc. As they keep on advancing through their academic studies, more challenging subjects will be taught. It is for this reason Lord Mahaveer propounded the Mahavratas for those who wish to follow the code of conduct strictly and Anuvratas for those who cannot follow the rigorous Mahavratas. Thus, the value of the option to practise religion is maximised by choosing your aspirations according to one’s current level.

(iii) The third factor to determine the value of a financial derivative is Time to Maturity. Taking the car insurance as an example, if you were to take out an insurance for 3 months, you would pay less than if you were to take out an insurance for one year.

Anecdotally, many people mention that youth is to enjoy and religion is to practise in old age. On the contrary, the value of an option is higher when the time span is longer.

Time value is grreater in youth compared to senile state. Moreover, youth have more energy and full of vitality compared to old age where people may have relatively abundant time, but other factors such as health may not be conducive.

Therefore, we should inculcate spirituality to our children since a young age so that morality and spirituality becomes an integral and holistic aspect of their lifestyle.

(iv) Higher the interest rate, greater is the financial option (call option) value. Each county determines the interest rates according to the state of their economy.

In religion, interest rate can be thought of as the environment we live in. For instance, in India temples, monks and nuns are abound compared to the Western World. Therefore, a child growing up in India is naturally exposed to spirituality due to the environment without any special efforts by the parents. This can be compared to a low interest rate environment. On the contrary, children overseas do not have as much exposure to temples / spirituality and thus parents need to take extra efforts to send their children to pathshala / gyanshala (religious schools) to inculcate moral and spiritual values. This is analogous to a high interest rate environment. Thus the option to practise religion is higher.

(iv) The last factor and perhaps the most important factor to determine the option value is Volatility. In financial markets, the greater the fluctuations of prices, the greater is the option value. This is because there is a greater probability of the underlying price to meeting the strike price. Let’s understand this from the car insurance perspective. If one lives in a rural area having a small population, perhaps with more mature drivers then the car insurance premium will be lower (lower volatility i.e. lower chances of having a car accident). If on the other hand, one lives is a busy metropolitan city with many young drivers, then the chances of having an accident are higher and therefore higher insurance premiums (higher volatility).

Looking at this from a spiritual perspective, say if you are living in the East in a community upholding moral and spiritual values then there are less chances of anyone going astray. However, if one lives in the modern society exposed to all vices of the current era (drugs, vulgarity, violent computer games, filthy social media, etc) then it is analogous to living in a volatile environment and thus the option to practise religion is very high.

In conclusion, this is a qualitative application of the financial option pricing model to spirituality. I have taken the key parameters to determine the option value of financial products and correlated them to the spiritual realm. No matter what faith or religion one follows, it is imperative that parents inculcate moral and spiritual values to their children as they can have a meaningful, holistic and spiritual life ahead of them.